Improve your institutional wallets to robust wallets with the top MPC wallet development company. The goal is to offer enhanced asset protection, fostering peace of mind.

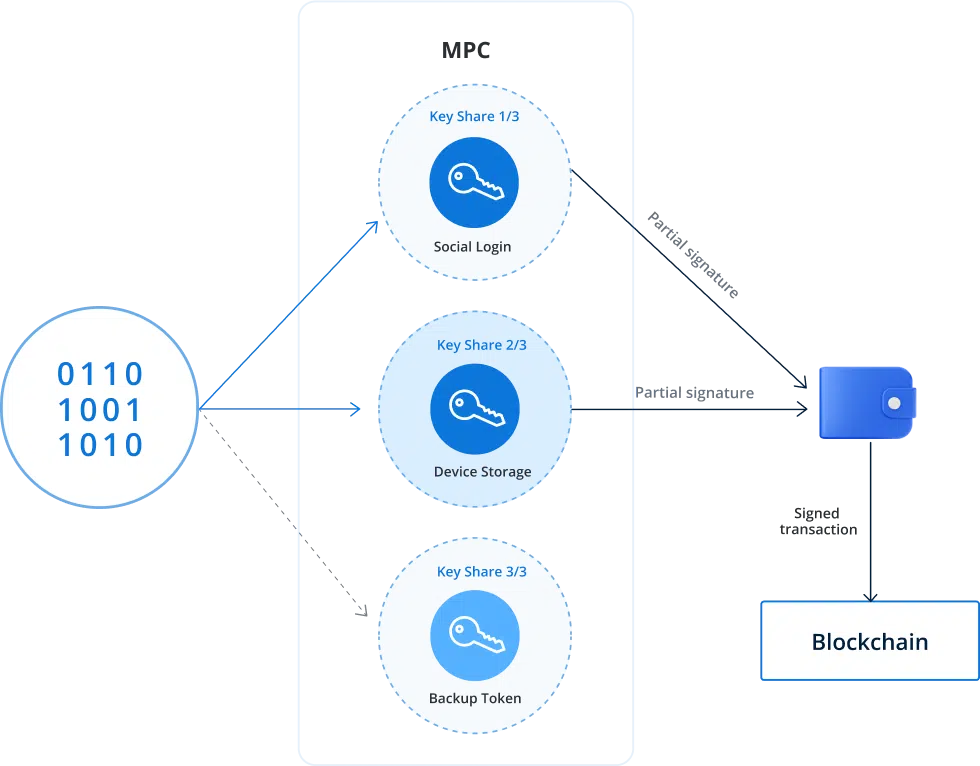

MPC wallets have emerged as a game-changer to crypto asset security. They leverage advanced cryptographic mechanisms by dividing the private keys into Shards and distributing them across different servers. Their decentralized architecture mitigates Single Point of failure, making them resistant to hacks and breaches. The distributed approach offers greater transparency and prevents unwanted access, which benefits enterprises sharing digital assets.

Bloom Genesis the preeminent MPC wallet development company has changed the face of crypto security by curating customizable MPC wallets. The solutions offer unrivalled security, streamline DeFi workflows and improve the efficiency of varied-size businesses. Our skilled team comprises cybersecurity experts, blockchain developers and cryptography experts who tailor hyper-protected and seamless solutions poised to set a new standard within the crypto domain. Kickstart your development journey & expedite your wallet launch by 7 days.

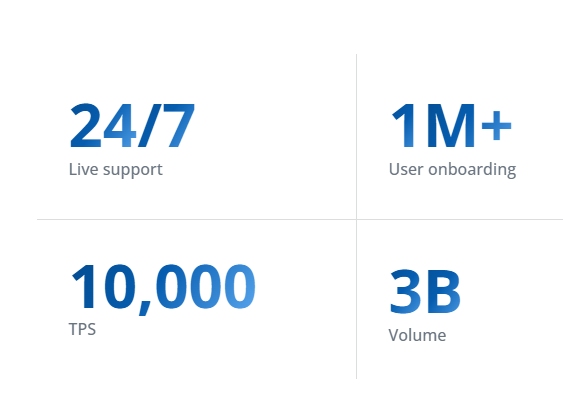

Numbers speak louder than words! Here is what makes us a trusted name for blockchain game development.

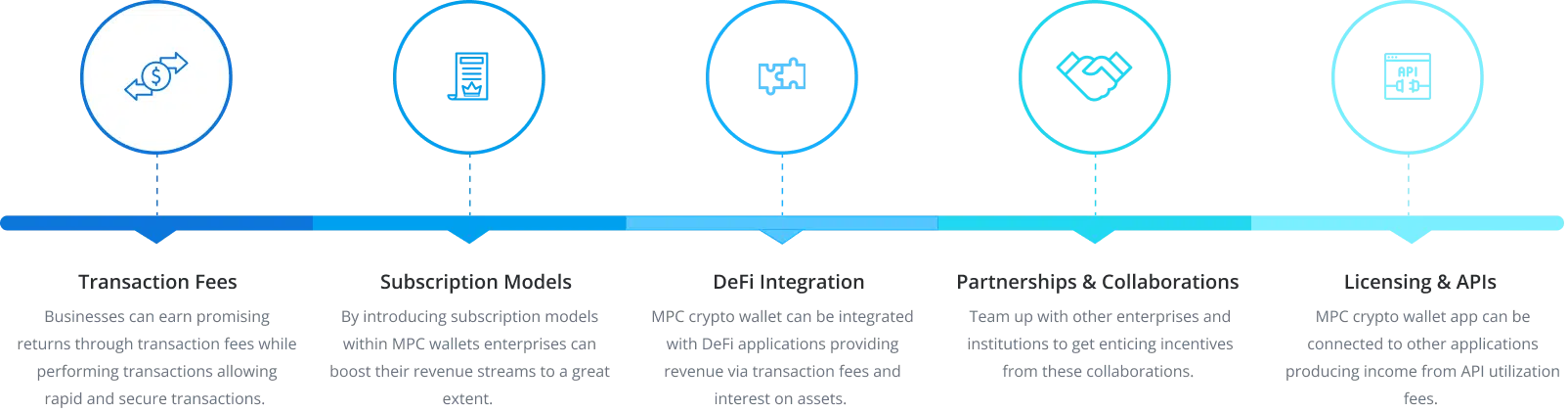

Let us dive into the most compelling use cases of the MPC crypto wallet app for businesses:

We have divided the MPC crypto wallet development process into simple steps which on completion will provide a secure and reliable solution covered below:

Distributed ledger identity management has the potential to transform both user experiences and business processes. Users can enjoy improved privacy and security as they acquire more control over their personal information. Consequently, this diminishes the likelihood of identity theft and unauthorized data access. Conversely, businesses can profit from optimized identity verification procedures and enhanced interoperability, resulting in increased efficiency and reduced operational expenses, coupled with robust fraud prevention measures, easier regulatory compliance, strengthened customer trust, and decreased financial risks.