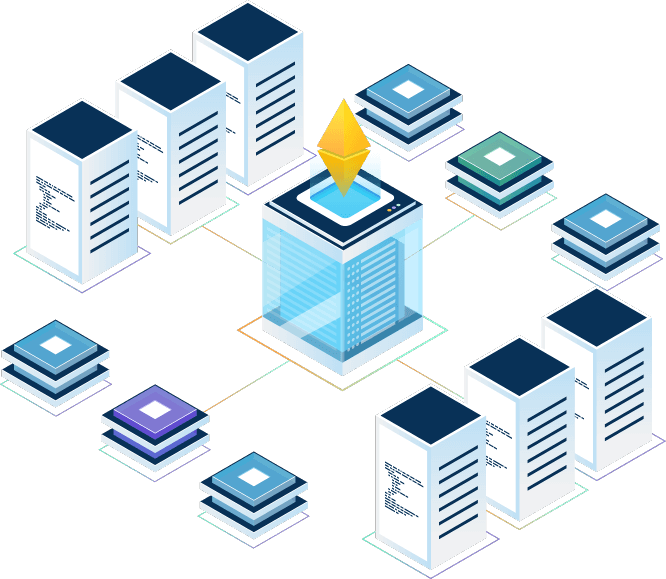

Crafting customized DeFi lending & borrowing platforms with our premium DeFi lending platform development services to fill up the gaps in traditional finance.

Yield farming refers to the process of earning rewards by staking cryptocurrencies or any other digital assets. It incentivizes liquidity providers to stake or lock up their crypto assets in a smart-contract-based liquidity pool. The higher the number of funds added to the liquidity pool, the higher the rewards.

As an ingenious application of decentralized finance (DeFi), yield farming has acquired significant popularity globally. The yield farming market grew from $500 million to $10 billion in 2020, making it the biggest driver of growth of the still-nascent DeFi sector. Get in touch with our DeFi yield farming development company to know more about our offerings.

Numbers speak louder than words! Here is what makes us a trusted name for blockchain game development.

Integrating blockchain into game development offers several advantages:

True Ownership of In-Game Assets: Blockchain allows players to have true ownership and control over their in-game assets.

Enhanced Player Engagement: Blockchain games often introduce unique gameplay mechanics and economic models that incentivize and reward players.

Decentralized and Transparent Economy: Smart contracts and blockchain technology enable secure and trustless transactions, eliminating the need for intermediaries.

Anti-Cheating and Fraud Prevention: Blockchain's immutability and decentralized nature can help combat cheating and fraud in games.

Innovative Funding Models: Through Initial Coin Offerings (ICOs) or token sales, businesses can directly raise funds from the community, reducing reliance on traditional funding sources.